Working with GA Hard Money Lenders: Secure the Funding You Need for Your Property

Working with GA Hard Money Lenders: Secure the Funding You Need for Your Property

Blog Article

Is a Difficult Cash Loan Provider Right for Your Following Financial Investment Building?

When assessing whether a hard money loan provider is suitable for your next financial investment residential property, it's essential to think about both the advantages and possible disadvantages of this funding alternative. Difficult money fundings can facilitate fast financing, making them appealing for urgent investment possibilities.

What Is Tough Cash Loaning?

Difficult cash borrowing is frequently made use of by real estate capitalists seeking quick financing services. This sort of borrowing entails temporary financings secured by property, commonly offered by private capitalists or firms instead than typical banks. The finances are mainly asset-based, suggesting the residential or commercial property itself functions as security, which permits a streamlined authorization process that can bypass the extensive documents and credit score checks typically connected with conventional loans.

Tough money finances are generally defined by greater rate of interest and shorter payment terms, usually ranging from 6 months to a few years. These finances are popular amongst investors that need to act quickly in competitive realty markets, such as during property flips or procurements that call for fast cash money. Unlike traditional lenders, hard cash lenders concentrate much more on the value of the home as opposed to the customer's credit reliability, making it an appealing choice for those with restricted credit rating or urgent economic demands.

While hard money providing deals prompt accessibility to resources, it additionally features increased financial threats, consisting of the capacity for foreclosure if the loan is not paid off as concurred. Understanding the ramifications of tough cash loaning is important for potential customers.

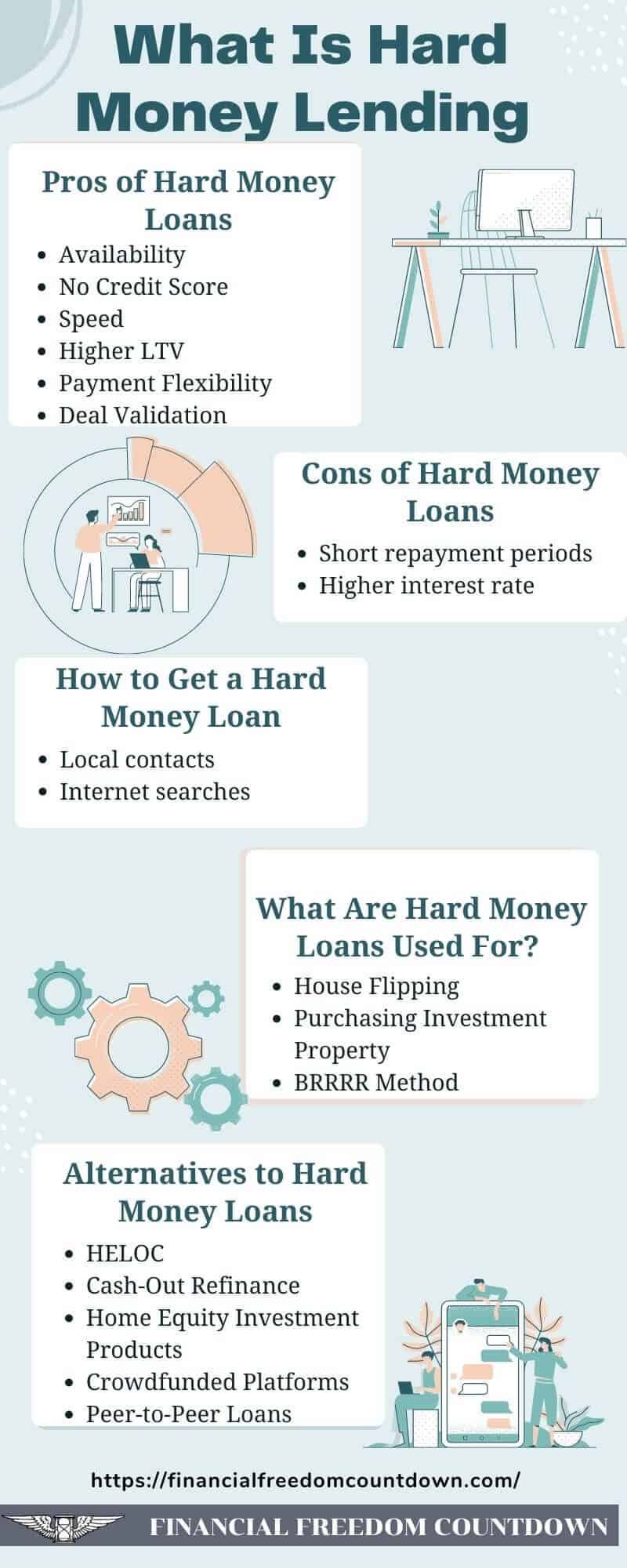

Advantages of Difficult Money Finances

What benefits do hard cash finances use to actual estate capitalists? One significant advantage is rate. Tough money financings can commonly be secured much faster than traditional fundings, favorably and funding occasionally occurring within days. This fast accessibility to funding permits capitalists to seize opportunities quickly, particularly in open markets - ga hard money lenders.

Additionally, hard cash lending institutions generally concentrate on the building's worth instead of the customer's creditworthiness. This can be useful for investors that might have a less-than-perfect credit report however possess a strong investment approach. The adaptability of hard cash finances is one more enticing aspect; lending institutions might use even more tolerant terms that can be customized to fit particular investment requirements.

Moreover, tough cash car loans are specifically beneficial for fix-and-flip capitalists. They supply the necessary funding to buy and renovate residential or commercial properties, making it possible for capitalists to take advantage of temporary jobs without the lengthy authorization procedures related to standard financing.

Lastly, the potential for greater leverage with difficult money car loans means capitalists can fund a larger portion of the home's purchase price. This enables greater financial investment possibilities and the capacity to diversify their realty profiles better.

Risks to Think About

While tough money lendings existing many advantages genuine estate investors, it is necessary to also acknowledge the potential dangers related to this form of financing - ga hard money lenders. One considerable danger is the greater rate of interest compared to typical financings, which can bring about boosted financial strain if the building does not create expected returns

Additionally, hard money fundings typically include shorter payment terms, typically varying from one to three years. This requires a quick exit strategy, which might not constantly be viable, particularly if the marketplace is negative during the lending period.

Moreover, tough money loan providers may impose strict problems and charges that can additionally blow up the cost of loaning. Investors should also be cautious of the potential for repossession, as these loans are safeguarded by the property itself. Failing to pay back the financing can cause losing the financial investment, along with any equity constructed.

Lastly, the absence of governing oversight in the tough money offering market can bring about predatory methods, making extensive research official website study and due persistance essential. Comprehending these risks is essential for investors considering this financing option.

Who Should Utilize Hard Money?

Capitalists looking for fast accessibility to capital genuine estate chances might discover difficult money car loans especially beneficial. These financings are suitable for those that require immediate financing to confiscate time-sensitive bargains, such as troubled buildings or repossession public auctions. Difficult cash lenders typically prioritize the worth of the security over the debtor's creditworthiness, making these car loans accessible to individuals with less-than-perfect credit report or minimal financial background.

Real estate investors concentrated on fix-and-flip jobs can additionally significantly benefit from hard money loans. These finances provide the necessary funds for purchasing and remodeling homes, permitting capitalists to rapidly transform about and cost a profit. Additionally, seasoned capitalists aiming to expand their portfolios might make use of difficult cash loans to leverage existing equity and money multiple tasks at the same time.

Furthermore, entrepreneurs in niche markets, such as industrial property or land development, can find difficult money lending beneficial due to the adaptability and fast authorization procedures included. Overall, difficult cash fundings are specifically suited for those that require swift financing and have a clear approach for payment through property sales or refinancing, enabling them to take advantage of lucrative investment chances.

Alternatives to Hard Cash Lending

Discovering choices to difficult cash financing can offer actual estate investors with numerous funding alternatives that might much better suit their financial situations and task timelines. Conventional financial institution finances are frequently a feasible option, supplying lower rate of interest and longer payment terms. These car loans generally need a comprehensive debt check and comprehensive documentation, which might postpone access to funds but can be much more positive in the future.

One more alternative is personal money financing, where teams or people lend their individual visit the site funds - ga hard money lenders. This technique often entails more adaptable terms and faster approvals, although rates of interest can differ dramatically based on the lender's expectations and the consumer's risk profile

In addition, crowdfunding systems have become a contemporary funding option, enabling investors to elevate resources from a pool of private investors. This strategy can diversify funding sources and minimize individual monetary risk.

Finally, home equity lendings or lines of credit history (HELOCs) can utilize existing residential or commercial property equity for funding his comment is here new financial investments. These options offer distinctive advantages, commonly making them a lot more available and economical contrasted to hard cash loaning, depending on the investor's distinct scenarios and financial investment technique.

Final Thought

To conclude, difficult cash offering benefits both presents and challenges for financiers seeking quick financing for property procurements. The ability to secure capital swiftly can be beneficial for time-sensitive jobs, yet the higher rate of interest and shorter payment periods demand mindful consideration of the linked threats. A detailed evaluation of financial scenarios and financial investment strategies is necessary for identifying the relevance of hard cash financings in achieving particular financial investment purposes.

What advantages do hard money lendings use to actual estate capitalists? Difficult money lendings can commonly be secured much faster than standard financings, with authorization and financing in some cases taking place within days.Financiers looking for quick accessibility to resources for real estate opportunities might find difficult cash car loans specifically useful.Genuine estate financiers concentrated on fix-and-flip projects can additionally significantly profit from difficult money car loans. Furthermore, seasoned capitalists looking to broaden their portfolios might make use of difficult money finances to take advantage of existing equity and financing several jobs simultaneously.

Report this page